Top 5 Best Prop Trading Firms An Overview

Are you a risk-taker who is looking for autonomy and independence in a career with high-income potential? If you’ve got an entrepreneurial spirit and are constantly looking to learn, you might consider a career at one of the best proprietary trading firms around the globe.

Considering how many hundreds of billions of dollars are traded monthly around the world, it’s an appealing career decision to work as a professional trader. And if you’re especially ambitious, a prop trading firm can offer you the greatest rewards— although it’s a cutthroat field with tons of turnover and volatility.

But if you’re talented enough to make it as a prop trader, the next step is to find one of the top proprietary trading firms that will help you find those juicy profits. You want to make sure you’re getting the most value out of your time and capital, so research is essential.

Fortunately, we’ve done all the groundwork for you.

Listed below are the 5 best proprietary trading firms in the business. Each of them has something that sets them apart from the rest and a solid place to take your trading skills.

From Forex prop trading firms to other funded traders, read on to see what each proprietary trading firm has to offer!

Top 5 Best Prop Trading Firms: Our List

1. Fidelcrest Prop Trading Firm Review

Fidelcrest is one of the best prop trading firms because it allows any lot size on its site. You aren’t locked into higher monetary tiers, which allows you to only trade at the level you’re most comfortable with.

They also offer the opportunity to work as a proprietary trader remotely. This remote working arrangement allows skilled traders to have more flexibility in terms of their location and work hours. It can be particularly appealing for professional traders who prefer a more flexible lifestyle or want to avoid the constraints of a traditional office environment. Experienced traders continuously list this type of flexibility as one of the reasons why they are successful traders and score jobs in the best forex prop trading firms.

Fidelcrest Prop Trading Details

Fidelcrest also appeals to every lot size out there. They understand that people have different confidence levels and trading strategies; that’s why they’ve gone out of their way to make the work process as straightforward as possible. Accounts of any size can access all of their tools and use them to maximize profit. Doing so makes it much easier for prop traders to get their businesses off the ground.

Wondering how it works?

FidelCrest’s ProTrader program allows you to invest anywhere between $10k to $1 million as your initial capital. These can be used for micro, normal risk, and aggressive trading plans. Thanks to that, you have a great deal of freedom when it comes to utilizing your initial capital.

Fidelcrest does not require traders to provide their own capital or financial instruments to start trading. Instead, they provide traders with a funded trading account, allowing them to trade with real money without the need for personal investment. This can be advantageous for individuals who may not have significant capital but still want to pursue a career in proprietary trading. These very relaxed trading rules combined with the pros below are examples of what make Fidelcrest one of the best prop firms around.

Fidelcrest Prop Trading Features

- Minimum 10 Trading Days

- Multiple Trading Challenges

- Custom Profit Targets

- High Post-Verification Shares

- 20% Maximum Loss

Fidelcrest Pros and Cons

-

One-Time Only Fee: Anyone starting out with Fidelcrest only needs to pay a single startup fee. There are no hidden costs!

-

Account Analytics: Included with this prop firm course is a proprietary trader progress tracker. This shows you important account metrics you can use to enhance your work.

-

Comprehensive Training and Mentorship: Fidelcrest provides comprehensive training and mentorship programs to help traders develop their skills and start trading forex right away. They offer educational resources, coaching, and guidance in the financial market, allowing newcomers to learn from industry professionals and enhance their trading abilities while benefiting from customer support.

-

Low Starting Share: Starting traders only make 10-20% of the profits before verification. However, that can skyrocket to 80% for normal accounts and 90% for aggressive accounts once you’ve become a verified trader.

2. Topstep Trader Review

Topstep’s platform makes it easy for newcomers to start making money through prop trading firms.

Topstep is a well-known prop trading company that offers a unique platform for aspiring prop traders. While opinions on the “best” prop trading company may vary depending on individual preferences and goals, there are several reasons why Topstep sits at the number one spot of this prop trading firm list.

Topstep Proprietary Trading Details

For one, Topstep’s platform makes it easy for newcomers to start making money through prop trading firms.

Topstep offers a very beginner-friendly approach to futures and forex trading. They want to turn you into a better trainer by teaching you healthy trading strategies and habits to trade forex. Additionally, they mitigate risk by giving you fallback options like challenge resets and low weekly loss caps. Thanks to that, newcomers won’t have to worry about the financial cost of learning the ropes at one of the best forex prop firms.

Anyone can become an experienced trader if they stick with Topstep long enough. That’s because they offer coaching alongside funding— either live group sessions or one-on-one instruction. Suppose you plan on playing with their money. In that case, it’s highly recommended that you take advantage of these resources to ensure the highest possibility of success with one of the best prop trading companies.

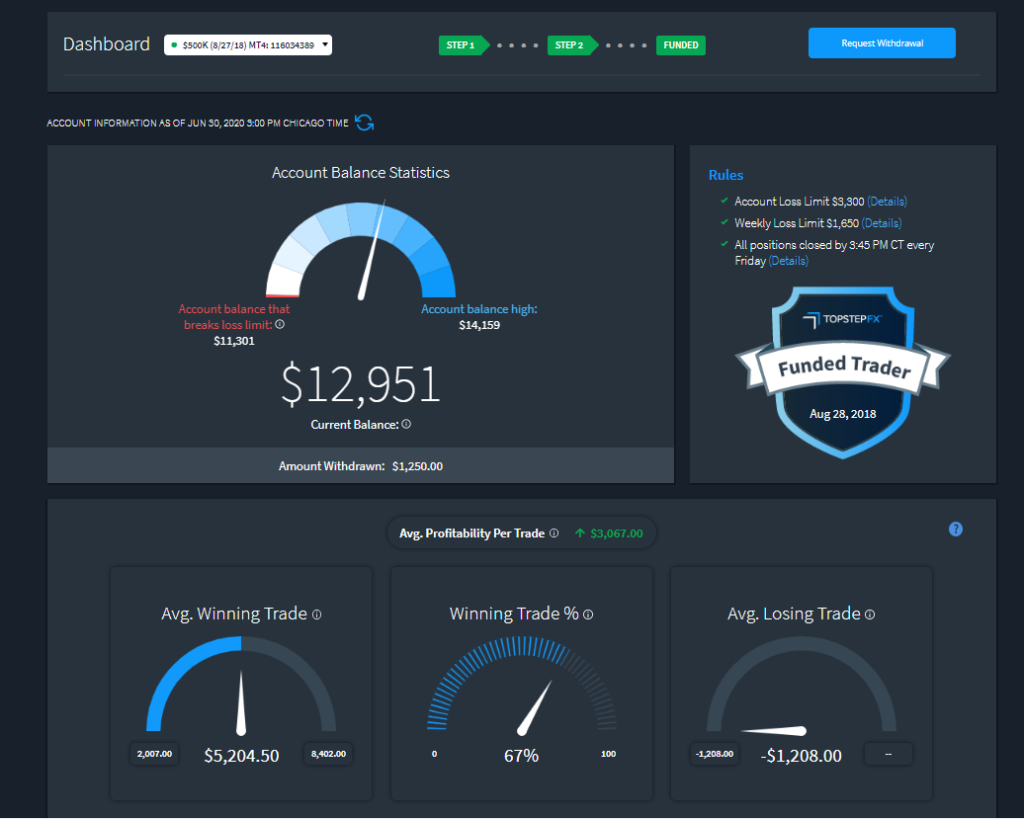

Topstep’s primary offering is its evaluation program, which allows traders to prove their skills and potentially earn a funded trading account. Traders start with a simulated account and work their way through specific profit targets and risk management criteria.

Successful completion of the evaluation program can lead to a funded account, where traders can trade with real money and keep a portion of their profits. This structure provides an opportunity for traders to showcase their abilities and access capital without needing significant personal funds.

It is important for futures traders to realize that buying power tiers are based on experience level. Those just starting out will stick around $50k to $100k. Later you can earn up to $500k in buying power after earning enough experience. Keep in mind that higher payment tiers have higher loss limits and profit targets to match for prop traders.

Topstep Review Features

- Keep the first $10k in profits with a simple payout policy

- 90/10 Profit Splits

- Forex and Futures Trading

- 6,000+ Accounts Funded

- 140+ Countries Represented

- Access to a Dedicated funding coach

TopStep Pros and Cons

-

Excellent Support: Topstep’s prop trading firm staff teaches you to mitigate risk, develop new strategies, and become consistently profitable. They want you to develop strong business skills while working with their proprietary trading firm.

-

Reputation and Trust: Topstep has established a solid reputation among other prop trading firms. It has been operating for several years and has helped numerous prop traders gain access to funding. The company’s commitment to fair evaluation processes, risk management, and providing opportunities for traders has earned it the trust of many aspiring prop traders.

-

Unique Trading Platforms: Transactions can be done via the MT4 platform. Doing so means you have 0 fees and access to powerful trading software that’s compatible on mobile and tablet devices. Other trading platform options include TSTrader, NinjaTrader, and QuantTower.

-

Regular Sales: Topstep is a prop trading firm that will frequently announce sales for their Trading Combine. These can bring down monthly costs dramatically— so it’s a great idea to take advantage of one whenever it comes along.

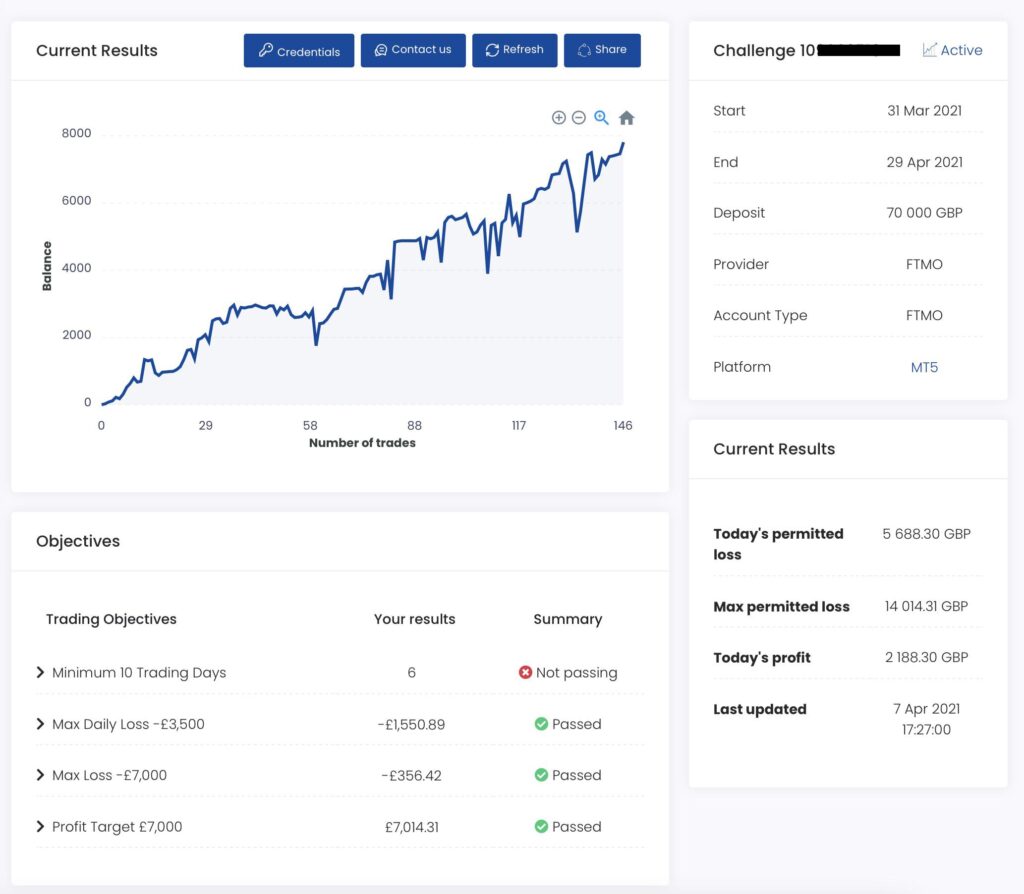

3. FTMO Review Prop Trading Firm

Here’s the best thing about FTMO— their profit splits highly favor you over the company. This can make earning money much easier and should be enticing enough to motivate you through the verification process.

With clear goals and guidelines, FTMO bears the risk of losses for traders in their evaluation and funded account stages. As a result, if a trader faces losses during the evaluation or funded stage, they are not personally liable for those losses. At any rate, this can provide a sense of security and peace of mind, particularly for traders who may be concerned about the financial risks associated with trading.

FTMO Proprietary Trading Company Details

FTMO lets you trade any instrument in which you’re interested: this includes stocks, bonds, crypto, Forex, and more. This makes for an appealing option if you want a diverse portfolio, but their high-profit splits make them even more appealing overall. Anyone verified by this company can earn up to 90% of the profits while FTMO covers the losses!

FTMO also provides educational resources and support to traders. They offer trading courses, video materials, and other learning resources to help traders improve their skills and enhance their trading strategies. This educational support can be particularly beneficial for traders looking to expand their knowledge and develop a deeper understanding of the markets.

FTMO Review Features

- Sing Account

- Scaling Plan

- Free Trial

- Performance Coach

- No Style Limits

FTMO Pros and Cons

-

Free Trial: FTMO lets you try out their service for a short time without paying. Doing so will let you get a feel for how they work before you sign up.

-

Multiple Account Options: FTMO offers different account options, allowing traders to choose the account size that suits their trading goals and preferences. This flexibility provides traders with the opportunity to start with an account size that matches their experience level and gradually progress to larger accounts as they prove their trading proficiency.

-

Difficult Verification: VFTMO has a stringent evaluation process that traders must pass to receive a funded account. While this process is designed to ensure traders have the necessary skills and discipline, it can be challenging and may require multiple attempts to succeed. Traders who are not confident in their abilities or prefer a less rigorous evaluation process may find this aspect to be a drawback.

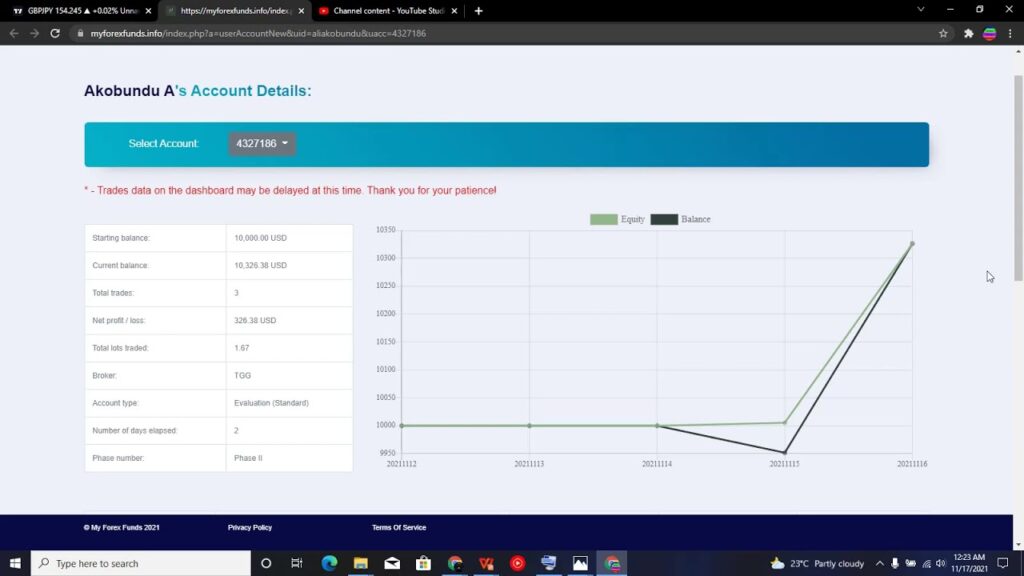

4. MyForexFunds Review Trading Firm

Founded in 2020, My Forex Funds is one of the newest trading firms in 2023. It offers you a great deal more freedom and flexibility compared to other prop firms. With this beginner-funded trader program, you can earn bonuses while being evaluated for high-volume trading programs. Professional traders skip the line with sufficient experience in trading instruments.

MyForexFunds Prop Trading Firm Details

Those interested in this prop firm must first complete a 2 phase evaluation. You have 30 days to complete each phase and must hit the respective 8% and 5% profit targets for forex traders or retail traders. The good news is that anyone in profit but not on target may qualify for a free extension. Plus, you have unlimited free retakes if you’re unable to meet your goals on the first try.

Currently, you can sign up for plans between $10k and $200k. Additionally, each of these comes with a different starting and overall draw down that reflects the costs involved. All registration fees are refunded after completion, and you don’t need to pay any monthly fees— unlike some of the other courses on this list.

You can always choose to combine this venture with another financial services undertaking like studying for the Series 7 exam.

My Forex Funds Review Features

- No Monthly Fees

- Up to 85% Profit Split

- Free Retakes

- No Trading Restrictions

- Lower Targets for Financial Markets

My Forex Funds Pros and Cons

-

Retakes: My Forex Funds lets you retake their evaluation challenge if you’re unable to pass it on the first try.

-

No Restrictions: This site doesn’t force any trading restrictions. All they ask is that you maintain consistency and focus on risk management.

-

Limited Support: Anyone using this site will have to work mostly solo. More freedom when trading means fewer helping hands overall. This can increase trading risks and impact one’s ability to trade successfully. This is especially true of forex trading newbies working on their trading skills.

5. SurgeTrader Best Prop Trading Firms

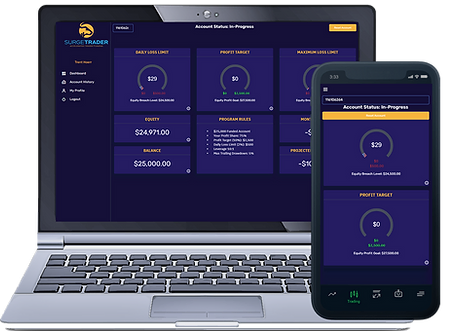

SurgeTrader allows for much higher trading amounts than other providers— up to $1 million for master traders!

How does this work?

SurgeTrader Prop Trading Firms Details

After applying, you’ll just need to take a one-step Audition, and once you achieve a 10% profit target, you receive a funded account — up to $1 million. At the same time, you get to keep up to 90% of your profits.

SurgeTrader Prop Trading Firms Details

The first thing you need to do when starting with SurgeTrader’s proprietary trading firm is to pick your preferred package. Packages can go as high as $1 million dollars, but the higher you go, the more difficult the audition will be.

Each payment tier has a progressively higher audition fee paired with a more difficult challenge. Anyone who passes the challenge will have access to the funds and will keep 75% of the profits made. As a result, just keep your loss limits and drawdown in mind while working.

Currently, you can choose from 6 different trading options between $25k and $1 million. You only need to pay a single audition fee for access. There are no monthly payments or hidden payments waiting in the wings. Just keep SurgeTrader’s rules in mind when trading and your work will be uninterrupted until the end.

SurgeTrader Proprietary Trading Firms Features

- Clear Trading Rules

- One-Time Audition Fee

- Instant Funding

- Easy Payout

- Flexible Trading

SurgeTrader Pros and Cons

-

No Minimum Trading Days: You can trade for exactly as long as you like when working with Surge Trader. No need to worry about hitting a minimum threshold.

-

User Friendly Portal: It’s easy to trade and navigate through SurgeTrader’s well-made dashboard. Your loss limits, profit target, and returns are all clearly visible at all times.

-

Difficult Auditions: SurgeTrader trusts you with quite a lot of money, and they want to be sure they pick the right people. Because of that, their evaluations are much more difficult compared to other prop firms.

Proprietary Trading Firm FAQs

How to choose the best prop trading firm for you?

All in all, we must look at factors like minimum trading requirements for getting funded, consider their fees, the UX of their trading platform, what other services they offer, look at reviews about customer service, as well as their reputation and ratings.

Are prop trading firms legit?

Most are, but that doesn’t mean they all are. Honestly, all of the ones we have vetted above are all legit, but always make sure to do your own homework and ask them the tough questions. If it seems too good to be true or they steer away from questions with excuses, then look elsewhere, but you won’t have that problem with the proprietary trading firms we have listed.

How do proprietary firms work and make money?

The best prop trading firms use advanced algorithms to access massive amounts of data to identify the most profitable opportunities. Proprietary firms then trade their capital with the intent of turning a profit. As with any investment opportunity, prop traders need to manage their risks to not take on bigger losses than they can afford. If you can analyze markets well enough, use their trading skills, and stay on top of business news to make worthwhile trades.

What is the best prop trading firm for you?

First of all, you’ll want to look at factors like minimum trading requirements for getting funded. Consequently, you’ll want to consider their fees, the UX of their trading platform, what other services they offer, and look at reviews about customer service, as well as their reputation and ratings. Overall, we suggest TopStep proprietary trading firm as our number one choice of prop firms.

Bryce Welker is an active speaker, blogger, and regular contributor to Forbes, Inc.com, and Business.com where he shares his knowledge to help others boost their careers. Bryce is the founder of more than 20 test prep websites that help students and professionals pass their certification exams.